Can you be your own financial planner? Do you have the ability to take your own decisions in financial planning? Can you be self-reliant when it comes to design your financial road map yourself? All of us are not great with maths and logic, which is required for excellent financial planning, so today I will share with you some simple tools using which you can plan for your financial goals. I will give you a spreadsheet designed by me for planning future financial goals.

Can you be your own financial planner? Do you have the ability to take your own decisions in financial planning? Can you be self-reliant when it comes to design your financial road map yourself? All of us are not great with maths and logic, which is required for excellent financial planning, so today I will share with you some simple tools using which you can plan for your financial goals. I will give you a spreadsheet designed by me for planning future financial goals.

Lets understand the basics first. There are number of things we have to consider when you want to plan for your future financial goals. They are

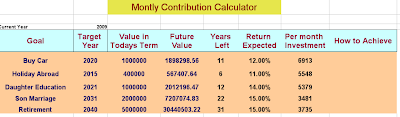

Input [ This is what you enter in spreadsheet ]

- Financial goal

- Current value in today’s term

- Target date

- Expected return from investment for that specific goal

Output [ This is what you will get as result ]

- What is the expected target amount

- How much you need to save per month for each financial goal

Download this spreadsheet : Monthly Contribution Calculator

Advantage of planning for each goal separately:

By doing this there will be more clarity regarding each goal and how it will be achieved, each of them will mature separately and you can take decisions based on changes to each of them, Also, it avoids mixing up too many things and achieving each goal becomes more realistic.

The reason why it becomes more realistic to achieve each goal is that first we identify goals, then we figure out the “realistic returns” required to achieve the goal. Based on these facts we figure out what is the amount we need to invest per month. So this a well thought process of arriving at the investment required to achieve each of the goal.

Important Points:

* If your goal tenure is less than 2 yrs, better put a return of 7%, preferred investments FD’s, FMP (fixed maturity plans) or debt funds, balanced funds for risk takers.

* If your goal is between 3-6 yrs, put 10-11%. Preferred investments in balanced funds, equity diversified funds or combination

* If your goal is more than 7 yrs, then you can put in range of 12-15%. Preferred investments in equity fund, sectoral funds, direct equity, can be combined with PPF.

* Understand that higher the tenure, more the return expected.

Disclaimer: At the end, you have to understand that returns expected can deviate from actual returns achieved in reality and hence there can be delay or early goal achievement, hence its recommended to assume the worst case scenario. I am sure this will deliver goal achievement in time :).

——–

This is a guest post by Manish Chauhan. He is the blogger behind Jagoinvestor. Manish aims to empower each person to be able to take their financial decisions themselves in their life. In this post he mentions about the important rules that investors must remember in stock markets.

Gaurav says

Yes Manish, thanks for the prompt reply, the constant amount model now make sense to me for short/mid term investments. For long term like 30 years, I would still go for incremental investments. (Inflation and Salary Increment is the Key. Future of Rs. 10 is say Rs. 1 after 10 years. Then I think we can save a little more than Rs. 10).

So I have thought about the incremental investment, and I come with following.

Assumptions:

Constant annual rate of return – r

Constant annual rate of increment in investment – i (I think Increasing investment month by month wont be practical, so I am going by annual Increment).

FV of your target = T

No. of years = n

Amount invested this year = A

then

sum [ A { ( 1 + i ) ^ k } { ( 1 + r ) ^ ( n – k ) } ] = T

where k varies from 0 to n-1.

Take values of i and r and n and T, and we can find A. Though I don’t know how to solve it in excel.

Idea here in this formula is :

we invest Rs. A in first year, so they keep invested for n years

so amount we get after n years is : A (1 +r) ^n

then we invest Rs . A (1 + i ) in next year and they keep invested for n-1 years.

so amount we get after n years is : A (1+i) . (1+r)^(n-1)

and so on…

Manish says

Gaurav

nice , Good work 🙂

Manish

Manish says

Gaurav

Your doubts makes sense . there are different models for investing for long term and yours suggestion is one of them .

The way I have suggested is a constant amount investing model , which might suit some and not suit some , Depends on individual capacity and ability. there are some reasons why this model can be considered .

1. In future , even though the salary and investible surplus increases , there will be other responsibilities which you can not think of today , so the amount you invest today for this particular goal will be a smaller percentage amount of overall salary and hence it would not look like burden .

2. There will be more and more amount of investment in the start , If you do constant amount investing , you can actually stop after investing 20-30% of tenure and still get 85-90% amount of target

This model can suit people who can save more in the start , but for people who have more responsibilities and have tight hands should take the other route as explained by you 😉 .

We can have the formula for this , try to find it first else come to by blog , i will be talking about it in future sometime for sure .. thanks for the idea .

What do you think about the whole idea ?

Manish

Gaurav says

Hi Manish, Hope you still check my post (long time since article has been written).

So keep any figures, say – I need 50 lakhs in 2045, nothing else, and I expect a return of 10% (I am not that good in equity markets, anyways these are numbers to explain my questions) and keeping the inflation at 6.5%, then my monthly investment is Rs. 11,376. Does it mean that i need to invest per month same amount till 2045, or this investment amount also increases with time and inflation. In my opinion it will be ridiculous (sorry) if this monthly investment remains constant over a spam of 35 years.

I am not so good with the formulas, I don’t even understand that formula you have used for calculating monthly savings, so here is the question : Is there any way by which we can give a rate (may be constant rate) to our monthly/yearly investment as well.

So i start investing say Rs. 5000 per month now, and then slowly keep increasing this to 40,000 per month in 2045. And i get same amount of Rs. 50 lakhs (FV = 48,256,507) in 2045. That would make more sense to me. Please help and guide

,

shraddha says

great ideas!

for someone unorganized like me..this is crucial!

Manish says

Thanks Shraddha

I am sure you can get organised with minimal efforts , Its not knoweldge or skills in personal finance , its just taking action and thinking logical and mathematical .

Manish

Chakri says

One thing I wan to clearly tell you is my intention is not to find the tool as wrong calculator. My intention is to project the scope of the tool to be used by a common man. How a common man will really take the inputs based on the result from the tool and get influenced with.

Yes, it is the person’s personal problem – how to save and how not to; whether to go for saving or not. But it’s the tools responsibility to sustain the thought of saving in the users mind. It just should not be an analyzer or calculator. It should be more than that. Ofcourse, final decision is left to the user. But my view is, how is that, the tool is going to influence the users thoughts. That influence can lead to change the definition of savings for the user.

When a person uses any tool, apart from the direct result, the impact of the tool on the usage also matters. Here, in this case, if the tool scares the user about the saving and if he stops planning for saving (lets just think this can happen for a while) then what is the scope of the usability of this tool.

Once again I am telling, I am not criticizing the tool and its functionality, I was just wondering about the kind of impact it can have on a common man. Coz, Common man never thinks about the logic behind the tool. He and his thoughts will be just carried away with the values. He definitely feels that the tool is misleading him.

Clarifications for personal note:

I’ve used the input values considering a common Govt. Employee – Reason, he is the exact margin to economy class change; a perfect middle class economy guy. I changed the target dates (only retirement date I didn’t change. The person starting his career now can be in job for next 30 years maximum). 10L is the minimum amount a govt. employee gets after his retirement including PF, and other saving schemes.

I accept the fact that early investors (for savings) never go for toss. But I find only 3 in number on a scale of 10.

Manish says

@Chakri

I understood that its not your intention to find fault with calculator , you are trying to say that the tools must have more than what it has right now .. Which is a personal view I think ..

My personal views are different which you may not agree and thats totally fine ..

I accept that the calculator could have been made more detailed and “influential” with more data in it , putting a “auto0-generated” Suggestions form .. That would be some “work” on my side. . which I will do some day .

However , coming to “Influncing” the thoughts , That is not a small task which will be very easy with a calculator . It takes lots of reading to develop it .. My readers who have been actively reading my articles or other sources are now fully influenced with the idea and now getting good feel of how to develop an attitude towards “;how to save and invest” .

you said “if the tool scares the user about the saving and if he stops planning for saving (lets just think this can happen for a while) then what is the scope of the usability of this tool.”

My views are different . If a personal can not accept that he needs to save a certain amount based on the numbers he himself gave in the calculator , then he is not accepting the fact that there is some “problem” . He has to accept this and find solutions for that rather than stop planning for saving altogether .. I agree than it can be disappointing for some one saving just 5k per month and seeing that he needs to invest (not only save) 15k if he wants to acheive his Financial goals (based on what ever info he gave in the calculator) .

He either has to increase his earnings or decrease his expenses or lower his expectations . Now this reason why he is in this situation is because “most probably” , he is too late in his life planning for things .

At the end , all kind of tools have been made for people who know/can use it . I would like to mention that I assumed that everyone who is reading the article or taking a calculator has that minimal amount of understanding of Financial planning . I guess it was mistake to assume that . I should have mentioned that . Apologies for that .

I would love to hear your views on this . I am not sure if we are on the same ground when putting your ideas , may be you are trying to say something and I am replying without understanding that thing and hence triggering another “I dont agree with you” reply .

It may be a communication issue on my part , Let me know if thats the case . Thanks for this wonderful conversation . atleast I have learned too much . Thanks to you .

Manish

Manish says

@Chakri

I have converted this useful discussion as a blog post on my blog , thanks for this talk , it will help my readers to join the conversation and we can have more thoughts on this topic . Many thanks to you .

Chakri says

By all means.

Chakri says

I got the answer for my question in my very first comment (Whom do you expect to use this tool?). It is – “I would like to mention that I assumed that everyone who is reading the article or taking a calculator has that minimal amount of understanding of Financial planning”. Its now clear that, usage of this tool need some knowledge FINANCIAL PLANNING. THIS TOOL IS NOT FOR SOME ONE WHO IS JUST STARTING HIS FINANCIAL PLANS.

I recognized this assumption and wanted to get you out of it. Coz, This assumption has carried you off track slightly. Now, I am happy that I helped you to re-focus on the roots the Basic problem of SAVINGS. And you can import effective suggestions into one’s mind.

Thatz it buddy.

Manish says

@Chakri

Wonderful 🙂 . Thanks man

Manish

Chakri says

One question to Manish Chauhan before going ahead with my comments. Whom do you expect to use this tool? Seems that you have Upper middle class of economy people & Higher class of economy people as the target to use this tool and plan for their savings.

As per the figures (default values) in the tool, definitely, a normal middle class person cannot save the said amount. Average salary for a lame middle class person is 30k to 40k. At the end of the month, if he don’t go for borrowing then thatz the best financial month for him. As per the tool, how can we expect one to save maximum of his salary? This chart really affects the mind set of the common man. It leaves him only two ways – either he need to earn a Lakh per month or don’t ever plan for savings. If not he need to change the definition of SAVINGS. Savings can be some part of his earnings but not all.

These kind of tools should be generic if not target specific.

Manish says

@Chakri

Its not mandatory to use the default values , The tool is a very personal thing to use . So a person from middle class will fill his own Goals , Values ,Target date , return expected (which he can generate by investing with his knowledge) .

You comments are a result of the default values I guess, for which I apologize .. I have changed the values in Spreadsheet now . This tool will be helpful for anyone . Its not related to Class of a person .

The tool just gives you the saving required per month for acheiveing your goals in the time frame and with risk you are comfortable with .

You said that middle class earns 30k or 40k , which is true for urban city but not for small cities .. people still make 15k , 20k .. But if started early in life one can achieve their targets easily ..

Let me know if your Doubt is resolved or not ? I am thankful for your Feedback .

Manish

Chakri says

Still I feel, some where the essence of reality is missing. Not getting convinced with the proportion of earnings and savings.

Eg:- (following the values to be entered in the fields in the tool)

Car – 2015 – 3L needs Rs. 4139 to be saved per month

holiday – 0 – 0 needs Rs. 0 to be saved per month

D’ Education – 2025 – 5L needs Rs. 1909 to be saved per month

Sons Marriage – 0 – 0 needs Rs. 0 to be saved per month

Reteriment – 2040 – 10L needs Rs. 864 to be saved per month

Closely, the total amount to be saved per month comes to Rs. 7000.

For a guy earning 30K, to save Rupees 7K with all other expenditure, is not a small thing. To meet his requirements, should be a miser then – no movies (it costs around Rs. 1000 for a family – dad, mom & son to watch a movie ), no luxuries to wife (shopping) and children (say pocket money).

Manish says

@Chakri

As I said … The tool is a just a giving you values based on the date you provide ..

I saw the numbers you have put in and to acheive these goals comfortably , 7k per month investment is required at any cost . Now if a person earns 30k , then no one can do anything .. Either he forgets some of the goals or earns more ..

There may be many 30k earners and many might be able to save 10k also , and some may not be able to save 1k also .. Now for them Its there personal problem of how to cut their expenses in such a way or optimize the expenses in such a way that their Future goals are also met .

Let me know your views on this .. this is an important aspect . Also let me know how is the tool responsible for . As I said earliar the biggest problem is not early investing .. if a person starts investing Earliar , then most of the problems which arise later can be minimized .

Personal Note :

The example you have given

Car – 2015 – 3L needs Rs. 4139 to be saved per month

holiday – 0 – 0 needs Rs. 0 to be saved per month

D’ Education – 2025 – 5L needs Rs. 1909 to be saved per month

Sons Marriage – 0 – 0 needs Rs. 0 to be saved per month

Reteriment – 2040 – 10L needs Rs. 864 to be saved per month

1. This example has all the Target dates same as what is was there by default .. I hope you are changing it to your personal Target dates ..

2. Why is Retirement Corpus 10L ? Is it really you think is your Retirement Corpus in 2040 ? By then your Monthly expenses would have increased to 7 times to today 🙂 .

Manish

Shreeni says

Manish: I don’t know how serious you intend to keep this spreadsheet. If you are, then you need to add more dimensions to this. Remember, as a long term goals gets closer, you need to make it more secure. If you keep all the money for your daughter’s/son’s marriage in stocks and the markets crash on engagement day, your would-be-Sambandhi might get pissed off.

So, to be correct, you need to ask when to switch it from a high risk to a low one and then make it work accordingly.

Ideally, there is no easy solution for financial planing and I hope your readers understand that. This is just yet another of those tools that people can refer to – but it won’t actually simplify the effort needed to constantly re-evaluate and adjust them. And doing all that re-adjustments is what makes it a hard problem.

Sorry, if I am busting the utopia here. 🙂

Manish says

@Shreeni

Point well taken … You have raised a very valid point . However there are two ways a person can take care of those issues ..

What you suggested is the best way of managing things.. Invest and then make sure that at the end things are safe by shifting it to safer instruments .

However , in the excelsheet I have recommended that Return from Equity should be taken around 15% over a long term. Now this 15% return already incorporated all the cycles of ups and down and net result will be 15% over long term .. This case considers even the crash just before the Goal date .. [ Assuming normal crash 😉 ]. I am taking the worst case scenario where investor does not even bother to look at his money till the last hr of use ..What you said is perfectly correct and recommended . but that needs involvement. Which most of the people are not ready with .

What I said just now above applies only for long term goals like child education and retirement which are more than 15+ yrs away.

To justify my point , Equities in the long run in India have delivered more than 16-17% return even after the crash . The best thing was to sell at high point and again buy lower , but you know how easy it is 🙂 . If there is enough involvement , then the returns would zoom to more than 20% in long run , no doubt ..

Thanks for raising this point . It was a fruitful discussion . Let me know if you disagree at some point or have suggestions 🙂

Manish

Manish says

Hi Shreeni – This is Manish, thanks for your reply, You can download the spreadsheet and edit it with your Goals and amount.. Try that.

Shreeni says

Manish: Yes, the comment was a satire on kids. 🙂

Manish says

No issues 🙂

Shreeni says

WTF, by the default values set in the spreadsheet, I won’t be able to save for those things. I desperately need to tell my kid(s) to f**k off on their own and leave my savings in peace. 🙂

Shreeni says

WTF, by the default values set in the spreadsheet, I won’t be able to save for those things. I desperately need to tell my kid(s) to f**k off on their own and leave my savings in peace. 🙂